Self employed 401k calculator

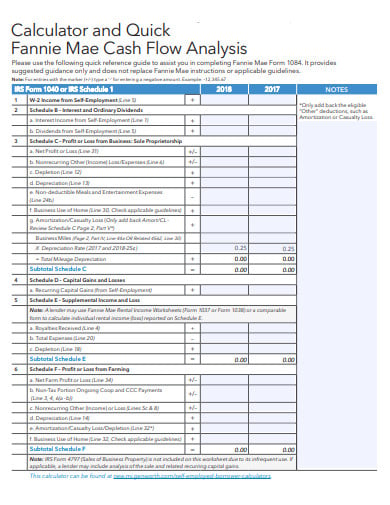

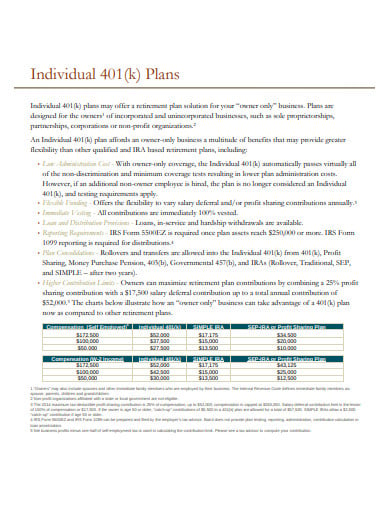

According to 2022 IRS 401 k and Profit-Sharing Plan Contribution Limits as an employee you. Use the solo 401k retirement calculator to calculate the maximum annual retirement contribution limit based on your income.

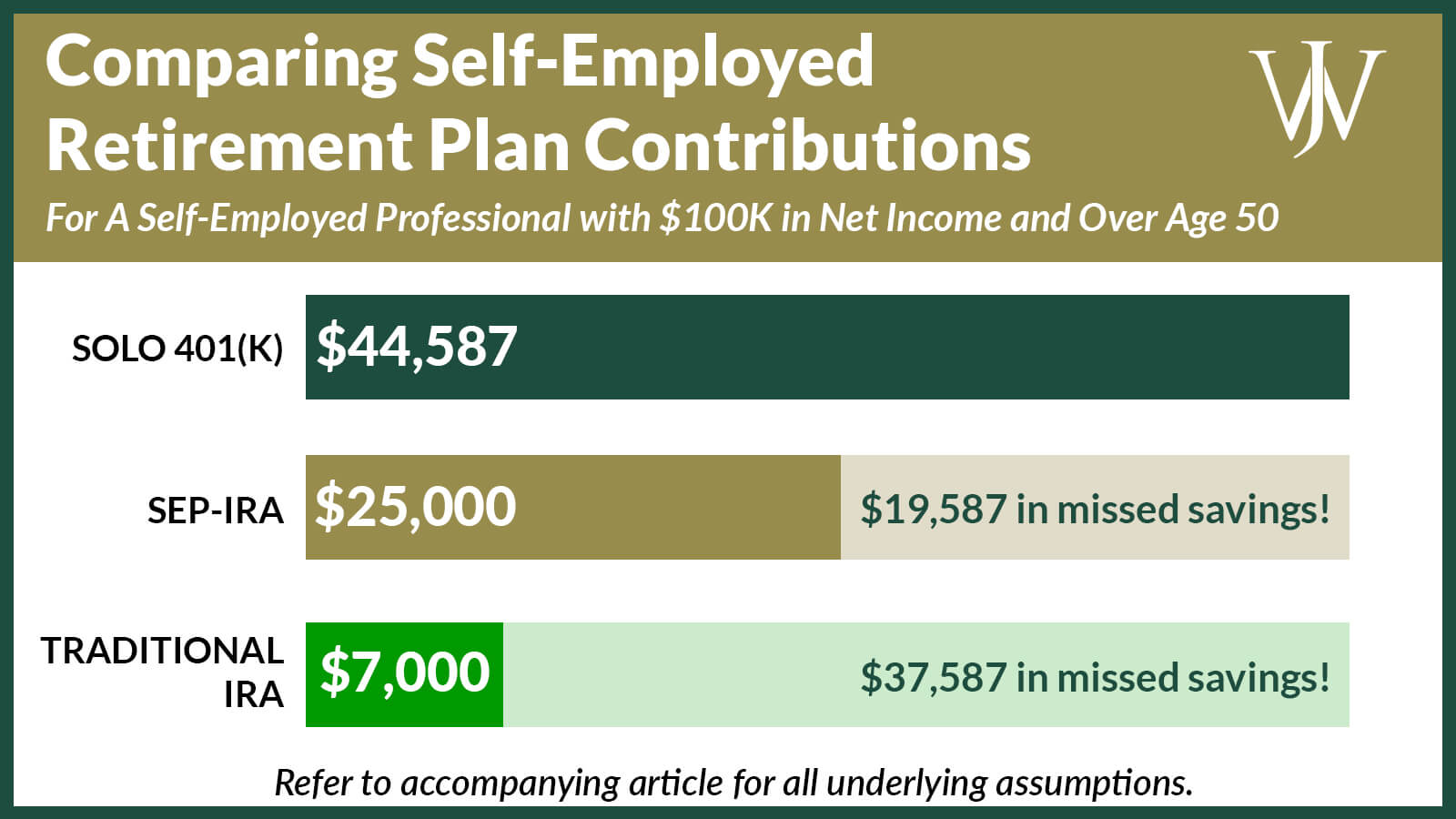

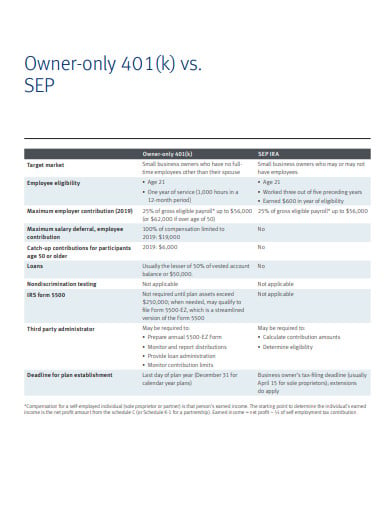

Self Employed How To Choose Between A Solo 401 K Sep Ira Retirement Savings

10 Best Companies to Rollover Your 401K into a Gold IRA.

. Use the self-employed 401k calculator to estimate the potential contribution that can be made to an individual 401k compared to profit-sharing SIMPLE or SEP plans for 2008. With this Self Employed 401k Income Calculator Template you will be able to prepare a self-employed invoice. Ad Get Personalized Action Items of What Your Financial Future Might Look Like.

In Just 3 Minutes Get Your Personalized Retirement Savings Action Plan. Our employed and self-employed calculator gives you an estimated income and national insurance tax bill based on your annual gross salary self-employment income self. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Specifically you are allowed to make. Solo 401 k Contribution Calculator. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income.

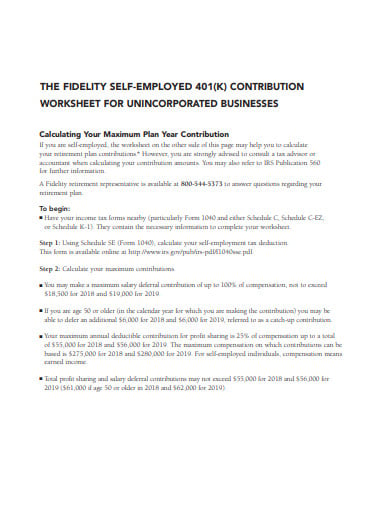

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Enter your name age and income and then click Calculate The. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA.

Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans. 1 Your salary deferral amount must be in accordance with your 401k Salary Reduction Agreement election made prior to your plan year. The solo 401 k.

Your retirement strategy should begin with a tax-advantaged retirement account but it doesnt have to end there. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer. Supplementing your 401k or IRA with cash value life insurance can help.

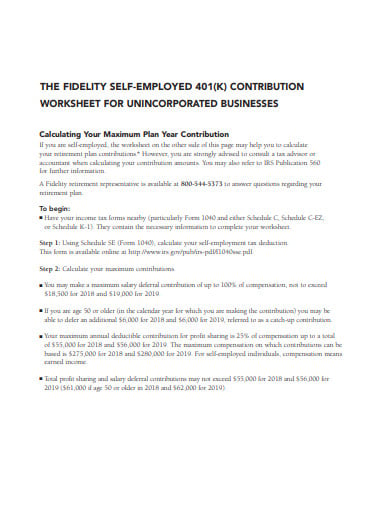

Complete a Self-Employed 401 k Account Application for yourself and each participating owner including the business owners spouse if applicable. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. An employee contribution of for An employer.

The one-participant 401 k plan isnt a new type of 401 k plan. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. In this sample you can get a complete report.

As a self-employed individual we have 2 roles - the business owner and the worker the employer and the employee. Solo 401 k Solo-k. Protect Yourself From Inflation.

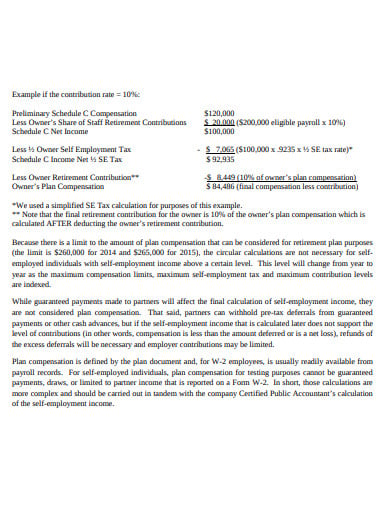

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. For self-employed individuals compensation means. In this example the consultant could contribute 26000 of salary deferrals 25000 profit sharing contribution 25 X 100000 51000 Total Self Employed 401k contribution.

If you are self-employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan. This is the maximum amount you are allowed to contribute to your Individual 401 k account per year. A one-participant 401 k plan is sometimes called a.

Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings. Ad Our 199 LLC formation service includes Bank Account provides everything you need. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual 401 k SIMPLE IRA or SEP-IRA.

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. In 2020 the maximum contribution to an Individual 401 k is 57000 for individuals. Form your Wyoming LLC with simplicity privacy low fees asset protection.

The highlight of the self-employed 401 k is the ability to contribute to the plan in two ways. Strong Retirement Benefits Help You Attract Retain Talent. Net adjusted business profit is calculated by taking gross self.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Understanding Solo 401 K After Tax Total Additions Limit For Sole Proprietorship Bogleheads Org

How Much Can I Contribute To My Self Employed 401k Plan

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

How To Calculate Solo 401k Contributions Self Employed Retirement Plan Youtube

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Limits And Types

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Calculator Solo 401k

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Here S How To Calculate Solo 401 K Contribution Limits

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Retirement Planning Good Credit

Solo 401k Contribution Calculator Solo 401k

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates